The Social Innovation Forum (SIF) launched its 4th annual Social Business Accelerator on January 19, kicking off 12 intense weeks of programming for the six social impact businesses in the cohort. Curious about what goes on in an accelerator? Interested in learning more about impact investing? We’ve launched this blog series, Insights into Impact Investing, to offer a glimpse inside our Social Business Accelerator and share some of our learnings from our work in the emerging field of impact investing.

On Tuesday, March 1, SIF held its 7th accelerator session for its cohort of six social entrepreneurs. SIF welcomed Christopher Mirabile, Chairman of the Angel Capital Association and co-Managing Director of Boston’s LaunchPad Venture Group, to host the session. Mirabile effectively shared his insights into raising capital and analyzing term sheets during both whole group discussion and one-on-one settings. His engaging speaking manner and ability to provide deft advice on the spot made for a captivating session.

When you are pitching to a customer, your product is your product. When you are pitching to an investor, your company is your product.

Mirabile began the discussion by providing some general insights into the capital raising process: “If you are a painfully shy person who struggles to network, you need to find someone else on your team to handle this process for you.” He went on to discuss the nuances of how to “borrow” someone else’s social capital and time – a necessary action that some entrepreneurs struggle to accomplish. With regard to pitching, Mirabile reminded the entrepreneurs to remember their audience: “When you are pitching to a customer, your product is your product. When you are pitching to an investor, your company is your product.”

In addition to the importance of this mindset, Mirabile also stressed that investors are looking for that entrepreneur who “can’t not do this, or is just crazy enough.” Although it may sound counterintuitive, investors are looking for an entrepreneur who doesn’t realize that what they are trying to do is impossible. According to Mirabile, these are the people who can really break down walls, and in this case, really address deeply entrenched social issues.

As the group asked more questions, Mirabile pointed out some of the most common pitching mistakes that he sees:

- “Every market analysis I’ve ever seen is inadequately segmented down. When you are a cash-strapped start-up, your market is really a narrow group of people for whom buying your product is a #1 priority. Your market is not every possible customer.”

- “When it comes to seeking capital, one of the biggest mistakes I see is that entrepreneurs are not raising enough. Your goal is to build a bridge, not a pier. Be very careful about the amount you raise and be able to defend it.”

- “I often see entrepreneurs provide too much detail on their financial projections. At the pitch level, this is a mistake. You can easily get bogged down.”

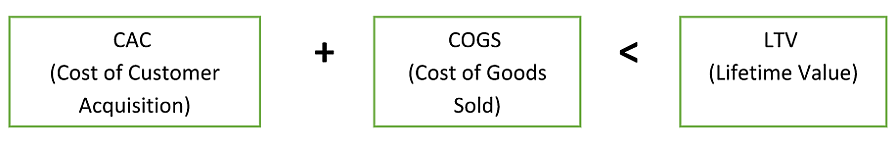

Another insight from Mirabele centered on one of the “key laws of business,” seen below.

According to Mirabile, every great start-up has a “hack” in at least one part of the equation above. A company like Facebook happens to have a hack in all three. Since users just add their friends, it is relatively simple for them to gain customers. It also costs very little to add a new account, which makes COGS quite low. The LTV is not high, since it’s not easy to monetize the average Facebook user, but since so many users are around for almost forever, there are a lot of “bites at the apple.” With this understanding, every entrepreneur listening to Mirabile was encouraged to identify where their own company hacks are.

Before meeting entrepreneurs one on one, Mirabile also discussed and answered questions regarding term sheets. He broke down some of the most basic elements and considerations regarding the topic, which was helpful since term sheets are often both elaborate and complicated. One of his insights regarding convertible debt was particularly memorable. According to him, convertible notes are a tempting solution, but have “metastasized” and become very much overused. They only make sense in two contexts:

- In between priced rounds, when an entrepreneur knows where the company is on the valuation curve.

- Very early in the capital raising process where transaction costs are paramount, and an entrepreneur wants to do the deal for at little cost as possible.

Mirabile stressed that convertible notes can be a problematic way to raise money. Since your investment as an entrepreneur will convert to equity, you’ll be rooting for a high valuation and your funder will be rooting for a low valuation, which results in complete goal misalignment. This is something that experienced investors don’t like, and therefore something to be avoided when the context isn’t right.

About the Speaker

Christopher Mirabile is the co-Managing Director of LaunchPad Venture Group. Christopher is a full-time angel and an active member of the Boston-area angel investing community with investments in more than 40 start-up companies. He was named one of XConomy's "Top Angel Investors in New England" for 2012. Christopher is an adjunct lecturer in the MBA program at Babson College, a regular advisor and mentor to start-ups, and a frequent panelist and speaker. He is a member of the Board of Directors or Board of Advisors of numerous start-up companies as well as several nonprofits. Christopher has served as a public company CFO with IONA Technologies PLC, a corporate and securities lawyer with Testa Hurwitz & Thibeault and as a management consultant with Price Waterhouse's Strategic Consulting Group. Christopher earned his JD from Boston College Law School and his BA, with honors, from Colgate University.

Interested in learning more from Christopher Mirabile? Please access some of his written work here.

About the Author

Marissa Silapaswan was the Social Innovation Forum’s Impact Investing Fellow from October 2015 – April 2016. In this role, she worked closely with SIF’s Executive Director to support the Social Business Accelerator program, including conducting outreach and recruitment, managing a network of mentors, and coordinating meetings, workshops, and events.

Social Innovation Forum

Social Innovation Forum